An Unbiased View of Mileagewise - Reconstructing Mileage Logs

An Unbiased View of Mileagewise - Reconstructing Mileage Logs

Blog Article

The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Discussing

Table of ContentsGetting The Mileagewise - Reconstructing Mileage Logs To WorkMileagewise - Reconstructing Mileage Logs Can Be Fun For AnyoneThe 3-Minute Rule for Mileagewise - Reconstructing Mileage LogsUnknown Facts About Mileagewise - Reconstructing Mileage LogsMore About Mileagewise - Reconstructing Mileage LogsThe Ultimate Guide To Mileagewise - Reconstructing Mileage LogsOur Mileagewise - Reconstructing Mileage Logs Ideas

Timeero's Fastest Distance feature suggests the quickest driving course to your employees' location. This function boosts performance and adds to set you back savings, making it a necessary asset for services with a mobile workforce. Timeero's Suggested Route attribute better boosts accountability and efficiency. Staff members can contrast the suggested course with the actual route taken.Such a strategy to reporting and conformity simplifies the commonly complicated job of taking care of gas mileage expenditures. There are many benefits associated with using Timeero to keep track of mileage. Allow's have a look at a few of the app's most notable features. With a trusted mileage monitoring device, like Timeero there is no requirement to fret about accidentally leaving out a day or piece of information on timesheets when tax time comes.

The Definitive Guide for Mileagewise - Reconstructing Mileage Logs

These extra confirmation procedures will certainly keep the Internal revenue service from having a factor to object your mileage documents. With precise mileage tracking modern technology, your workers don't have to make harsh gas mileage quotes or even fret regarding mileage expenditure monitoring.

If an employee drove 20,000 miles and 10,000 miles are business-related, you can compose off 50% of all auto costs (mileage tracker app). You will certainly require to continue tracking mileage for work also if you're making use of the actual expense technique. Keeping mileage records is the only means to different business and personal miles and supply the proof to the internal revenue service

Many gas mileage trackers allow you log your journeys manually while computing the range and repayment quantities for you. Many also come with real-time journey tracking - you need to start the application at the beginning of your journey and stop it when you reach your final destination. These apps log your begin and end addresses, and time stamps, in addition to the complete range and repayment quantity.

The 5-Second Trick For Mileagewise - Reconstructing Mileage Logs

This includes prices such as fuel, upkeep, insurance coverage, and the automobile's devaluation. For these prices to be considered insurance deductible, the lorry should be used for company purposes.

Unknown Facts About Mileagewise - Reconstructing Mileage Logs

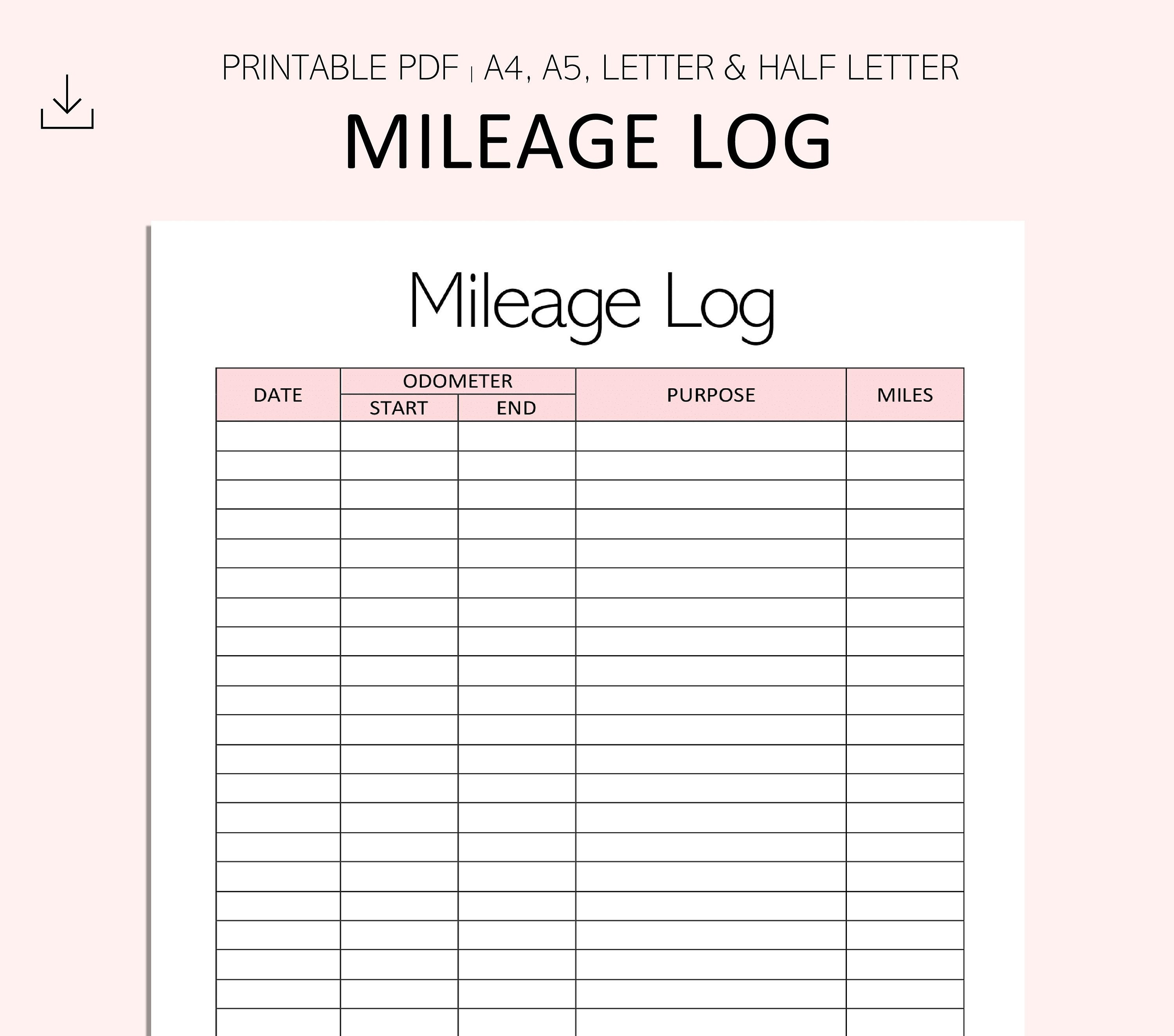

Start by recording your automobile's odometer analysis on January 1st and afterwards once again at the end of the year. In in between, carefully track all your service trips writing the starting and ending analyses. For each trip, record the location and business objective. This can be simplified by maintaining a driving log in your auto.

This includes the complete business mileage and overall mileage accumulation for the year (service + individual), trip's day, location, and objective. It's important to tape tasks quickly and preserve a coeval driving log detailing date, miles driven, and organization purpose. Right here's exactly how you can boost record-keeping for audit purposes: Start with making sure a precise mileage log for all business-related travel.

6 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

The actual costs technique is an alternative to the common gas mileage rate technique. As opposed to calculating your reduction based on an established rate per mile, the actual expenditures approach permits you to deduct the actual costs connected with using your vehicle for service functions - mileage tracker app. These costs consist of gas, upkeep, fixings, insurance, devaluation, and other related expenditures

Those with considerable vehicle-related expenditures or distinct problems might profit from the actual costs approach. Inevitably, your chosen technique needs to align with your details financial objectives and tax obligation scenario.

Mileagewise - Reconstructing Mileage Logs for Beginners

(https://fliphtml5.com/homepage/rmsrf/tessfagan90/)Whenever you use your vehicle for business journeys, tape-record the miles traveled. At the end of the year, once again write the odometer analysis. Calculate your total business miles by utilizing your start and end odometer analyses, and your recorded business miles. Properly tracking your specific mileage for organization trips aids in corroborating your tax obligation deduction, especially if you choose for the Requirement Gas mileage approach.

Keeping track of your mileage manually can call for persistance, yet remember, it might conserve you cash on your tax obligations. Videotape the total gas mileage driven.

Mileagewise - Reconstructing Mileage Logs - An Overview

And currently nearly everyone utilizes GPS to get around. That suggests nearly every person can be tracked as they go about their organization.

Report this page